Guide Opening a Business payment account Octopuspays

1. What you can do 2. Eligibility 3. What you will need 4. Register 4. Register Protect your business account by monitoring your My Business Account for any suspicious activity, which can include unsolicited changes to banking or mailing address, unauthorized appointment or changes of representatives or benefit applications made on your behalf.

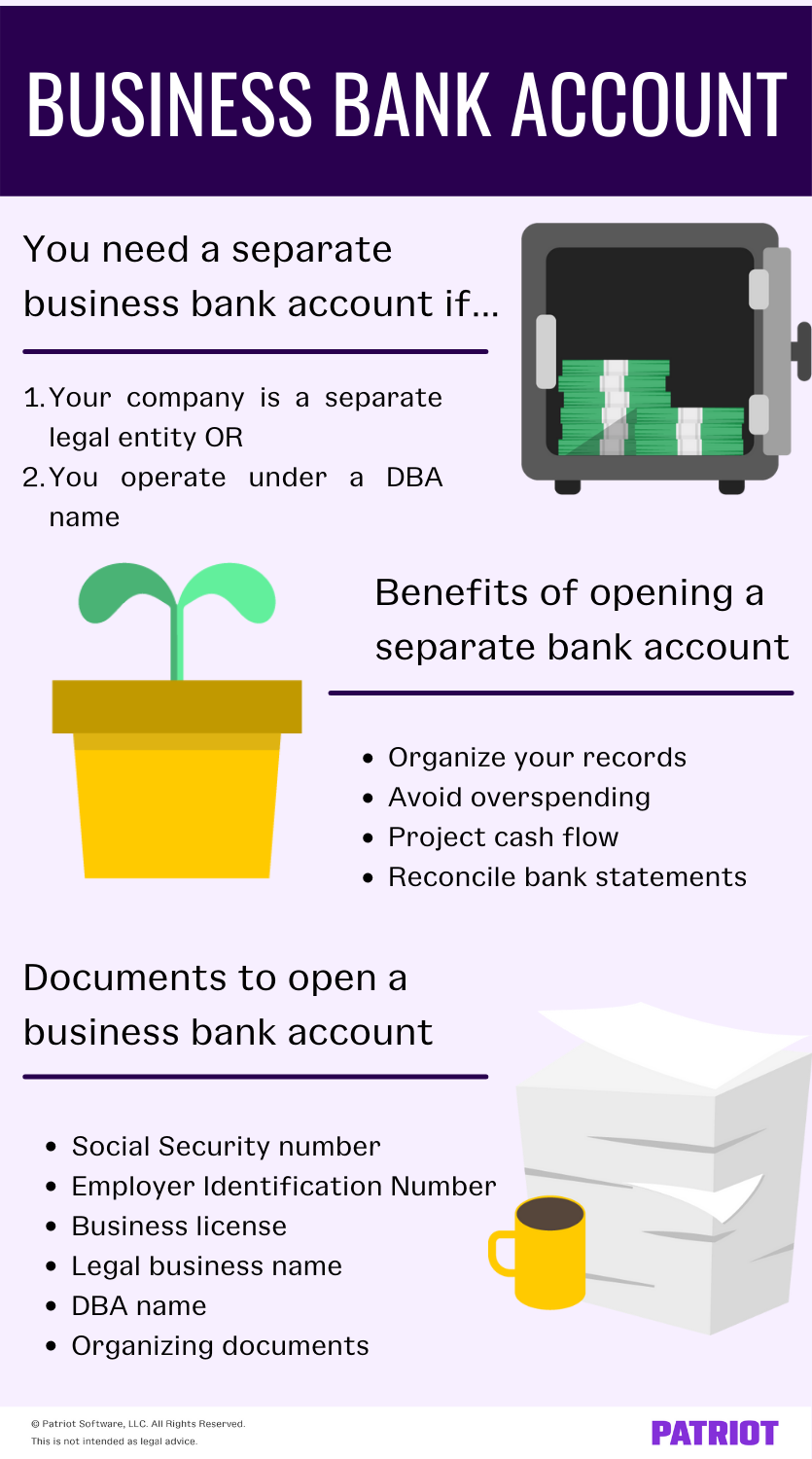

Do I Need to Open a Business Bank Account? Your Business Guide

Wise. Wise is a hassle-free money services business. The Wise business account can be used by businesses of all sizes.¹. You can pay employees, get paid and manage your cash flow overseas all in one place. You can also manage your money without dealing with high exchange rates, hidden charges and monthly fees.

How to Open a Business Bank Account NorthOne

Opening your business account online is fast, easy and secure. Once you complete your application you'll automatically receive your business bank account number, which will allow you to get your business up and running in no time. Please keep in mind, you may need to briefly visit the branch to verify your identity and activate your account.

Simple Steps to Open a Business Checking Account Online

Opening a business account is the first step to setting up your small business and keeping it legally compliant.. Financial technology companies offer various options, such as Loop Global Banking, Tangerine Business Account and Wise Business. Banks also provide a range of business savings account choices like Scotiabank Unlimited Account and TD Basic Business Plan.

Why do you need to Open a business account Open

Welcome Bonus will be earned and awarded to the Primary Business Cardholder of the $149 Account only after the first Purchase is made on the $149 Account, where such Purchase is made within 90 days of Account opening. The "Primary Business Cardholder" means the individual who is issued an $149 Account.

How to Open a Business Bank Account 4 Steps to Get Started

TD Small Business Bank Accounts offer a variety of features and benefits tailored to help you manage your money and grow your business. Compare, then choose the TD Business Chequing Account that helps meet your particular business needs. See all accounts Help me choose Featured accounts

The Best Places to Open a Business Checking Account Online mojafarma

Step 4: Set up online banking and activate your debit card. Once you've opened an account, the next step is to set up online and mobile banking. Be proactive and create a secure password for online banking and never download a mobile banking app from anywhere but the official app store for your phone.

Why Open A Business Account With A Bank?

Benefits of Opening a Business Account Having a business account can help you in several ways—here are just a few of the biggest benefits: Easily track and control your business expenses. A separate business account helps to prevent the confusion of having to figure out which transactions are business- or personal-related.

Top 4 Benefits of Opening an Online Business Checking Account

Open your account by phone: Most Popular Digital Choice Business Account Best for: Digital Banking Save time and money if you do most of your banking online. $6.00 / month 3 Apply Online Features Flex Choice Business Account Best for: Digital + In-Branch Banking

Opening a business bank account

Become a part of Leading Travel Agency with 100% Support & Guidance from local Experts. We Will Train, Support & Provide Your With Decades Of Expertise. Sign up today for webinar

How do I open a business bank account in the UK? The Exeter Daily

Premium Package. Ideal for a high number of all types of transactions. $95/month. $80/month with the Platinum Business. Mastercard® credit card. $0 with a balance of $80,000+. Unlimited electronic transactions 2. 100 transactions assistées 6. Unlimited cheque deposits by ABM, mobile, 3 and scanner 4.

How to open a business account

A value account that lets you pay only for what you use. Monthly fee2. $6.00. Transactions3. $1.00 for each self-service7 transaction. $1.25 for each full-service8 transaction. Deposits per month. Pay per use. Send up to $25,000 instantly across Canada with Interac e-Transfer® for Business.

How to Open a Business Bank Account Trademastr

Our Small Business Advisors and Healthcare & Professional Specialists will work with you to understand your business banking needs and provide you with relevant advice, tools, products and services to help your business thrive. Let Scotiabank be your trusted partner on the path to small business success. Start building your financial solution here:

Tips on Opening The Best Business Bank Account Crescendo Content Marketing

Check and gather all the information and documents required. Complete the application form in hard copy or online. Provide your documents to the provider - either uploading digital copies or presenting them in a branch. The bank or provider will verify your account, which may be instant, or may take a day or two.

The 5 Steps to Open a Business Bank Account UpFlip

Open a Business Bank Account - BMO Canada Business Business bank accounts Whether you're big or small, just starting out or in the middle of a growth spurt, find the best business bank account to help you reach your goals. Choose a business chequing account that matches your transaction needs and budget

How to Open a Business Bank Account

Having a business checking account can make it easier for you to keep track of tax-deductible business expenses, such as payments to vendors and contractors, business equipment, supplies,.